-

Services

-

Practice Areas

- Banking and Finance

- Capital Markets

- Corporate M&A

- Dispute Resolution

- Employment and Labour

- EU and Competition Law

- Healthcare, Life Sciences & Pharmaceuticals

- Intellectual Property

- Projects and Energy

- Public Law

- Real Estate and Tourism

- Responsible Business

- Tax

- Technology, Media and Telecommunications

-

Sectors

- Agribusiness

- Banking and financial institutions

- Distribution and retail

- Energy and natural resources

- Government and public sector

- Healthcare, life sciences and pharmaceuticals

- Infrastructure

- Insurance and pension funds

- Manufacturing

- Mobility, transport and logistics

- Real estate and construction

- Social economy

- Sports

- Tourism and leisure

- Desks

- Buzz Legal

-

Practice Areas

-

People

-

Knowledge

-

Newsletter SubscriptionKeep up to date

Subscribe to PLMJ’s newsletters to receive the most up-to-date legal insights and our invitations to exclusive events.

-

-

About Us

-

Apply hereWe invest in talent

We are looking for people who aim to go further and face the future with confidence.

-

- ESG

-

Services

-

Practice Areas

- Banking and Finance

- Capital Markets

- Corporate M&A

- Dispute Resolution

- Employment and Labour

- EU and Competition Law

- Healthcare, Life Sciences & Pharmaceuticals

- Intellectual Property

- Projects and Energy

- Public Law

- Real Estate and Tourism

- Responsible Business

- Tax

- Technology, Media and Telecommunications

-

Sectors

- Agribusiness

- Banking and financial institutions

- Distribution and retail

- Energy and natural resources

- Government and public sector

- Healthcare, life sciences and pharmaceuticals

- Infrastructure

- Insurance and pension funds

- Manufacturing

- Mobility, transport and logistics

- Real estate and construction

- Social economy

- Sports

- Tourism and leisure

- Desks

- Buzz Legal

-

Practice Areas

-

People

-

Knowledge

-

Newsletter SubscriptionKeep up to date

Subscribe to PLMJ’s newsletters to receive the most up-to-date legal insights and our invitations to exclusive events.

-

-

About Us

-

Apply hereWe invest in talent

We are looking for people who aim to go further and face the future with confidence.

-

- ESG

Informative Note

Approval of a package of tax measures to boost the capital market

14/06/2024On 12 June, the Portuguese Parliament approved a package of tax measures to boost the capital market. This package makes several important changes to the taxation of both investors and companies in order to boost the supply and demand for financing and investment through the capital market. The changes are designed to provide companies with the appropriate conditions to obtain capital or financing to carry out research, develop new products or skills that increase productivity, and to expand their sales domestically and internationally. These are the highlights of the new legislative package:

Incentives for medium and long-term holding of financial instruments

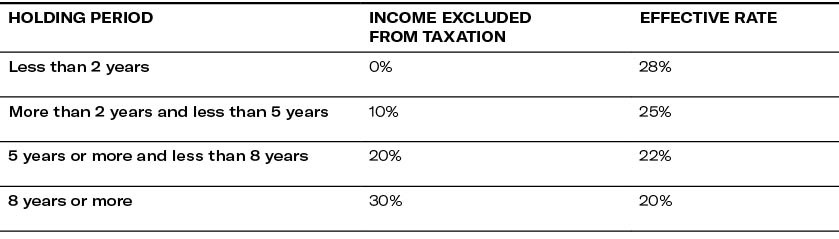

- As an incentive to hold financial instruments for the medium and long-term, capital gains realised on securities admitted to trading or on parts of open collective investment undertakings ('OICs'), in a contractual or corporate form, become partially excluded from Personal Income Tax (‘PIT’) up to 30%, if the assets are maintained for a period longer than 2 years, under the following terms:

Special tax regime for Pan-European Personal Retirement Products

- Creation of a tax regime applicable to the Pan-European Personal Pension Product (‘PEPP’) to stimulate savings, aligning it with the tax regime for retirement savings products:

1. Exclusion from PIT taxation of capital gains obtained from the disposal of properties intended for the taxpayer's or their family's own permanent residence. This exclusion only applies when the realisation value (deducted from the amortisation of any loan taken out to acquire the property and, if applicable, from the reinvestment in acquiring ownership of another property, of land for the construction of a property and/or its construction, or in the expansion or improvement of another property exclusively for the same purpose) may be used to acquire a PEPP.

2. Exclusion from Stamp Duty taxation of amounts invested in a PEPP.

3. Deduction of up to 20% from the PIT taxable amount of amounts invested in a PEPP under the same terms and conditions currently applicable to amounts invested in retirement savings, education savings and retirement/education savings funds (with a maximum deduction limit of €400, depending on the age of the investor).

Tax regime for securities investment companies and loans funds

- Securities investment companies and loans funds now benefit from the tax regime provided for venture capital funds, with the following tax framework being applicable:

1. Exemption from Corporate Income Tax (‘CIT’) in relation to income obtained by these entities.

2. Income relating to units or shares, whether by distribution or redemption, is subject to PIT or CIT withholding at a 10% rate. However, when paid to non-resident entities without a permanent establishment in Portugal, they benefit from an exemption from CIT.

3. Capital gains obtained by non-resident entities without a permanent establishment and non-resident natural persons are typically exempt from taxation in Portugal. When capital gains are realised by natural persons resident in Portugal who obtain income outside the scope of a commercial, industrial, or agricultural activity and the do not opt for those gains to be aggregated with their remaining income, a rate of 10% will apply.

Incentives to real estate collective investment schemes (‘CIS’) that promote affordable rental

- Creation of a special tax regime applicable to real estate CIS that invest in housing included in the Affordable Rental Programme, as a way of expanding incentives to offer housing for rent at reduced prices, to promote housing supply:

1. CIS will be eligible if: (i) they are established or their constituent documents are amended by 31 December 2025; and (ii) whose constituent documents provide that their assets must consist of 5% or more of property rights or other rights of equivalent content over properties intended for housing rental or subleasing under contracts framed within the promotion of housing rental or subleasing at affordable prices.

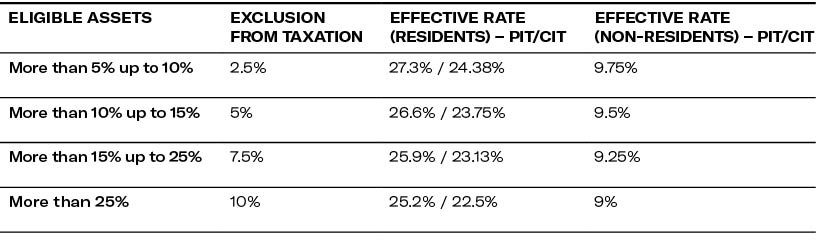

2. If these requirements are met, income earned by unitholders or shareholders benefits from a partial exclusion from taxation between 2.5% and 10%, depending on the percentage of eligible assets allocated to affordable rental:

1. A 25% reduction over the 0.0125% Stamp Duty rate (applicable over the overall net value of the CIS) is furthermore applicable to OICs that fall into the last bracket of the table.

Incentives for trading on a regulated market

- Expenses relating to the first admission to trading on a regulated market of securities representing the capital of micro, small or medium-sized companies, or companies of small-medium capitalisation (Small Mid-Caps) or medium capitalisation (Mid-Caps), as well as those relating to the offer of securities to the public carried out in the same tax period or in the tax period prior to such admission to trading, resulting in a minimum dispersion of 20% of their share capital, are increased by 100% of the respective amount for the purposes of determining the taxable income.

1. In the case of second admissions to the regulated market, the same regime is applied, without dispersion of minimum share capital, with eligible expenses and losses increased by an amount corresponding to 50% of their amount, for the purposes of determining taxable profit.

2. Increase in CIT eligible costs relating to admission to trading or obtaining capital or financing on the market, for Small Mid-Caps or Mid-Caps.

3. Expenses for this purpose are considered to be expenses associated with fees, commissions and other charges directly relating to admission to trading, including those corresponding to preparatory acts necessary for it, as well as intermediation expenses, directly relating to the first admission to trading of its securities on a regulated market.

The entry into force of the legislation containing these measures is now pending ratification by the President of the Republic and subsequent publication in the official gazette (Diário da República).